MicroStrategy Q2 2025 Earnings Report: When Bitcoin Moves, MSTR Surges

As a trader deeply entrenched in the intersection of equity markets and digital assets, I was keenly watching MicroStrategy's Q2 2025 results—and let me tell you, they didn’t disappoint.

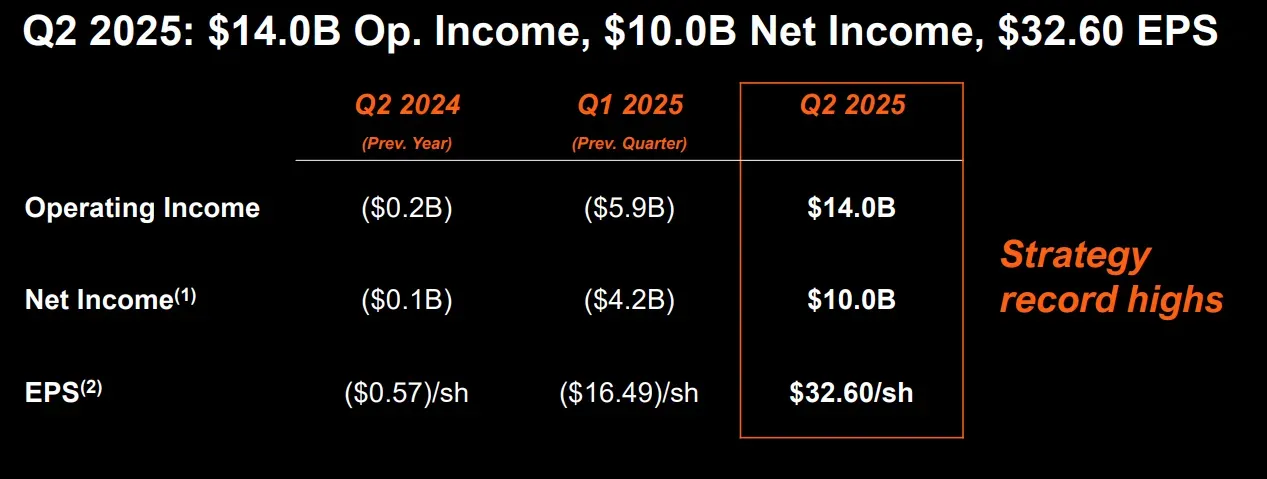

The report was nothing short of a jaw-dropper, sending ripples across both traditional financial circles and crypto-native communities. MSTR didn’t just beat expectations; it obliterated them. The company reported a staggering EPS of $32.60 against a consensus estimate of -$0.12. That’s not a typo—it’s a 33,000%+ upside surprise.

What drove this? A single word: Bitcoin. MicroStrategy’s $14 billion swing in net income was almost entirely attributable to unrealized gains on its colossal 628,791 BTC stash, which climbed in value to $64.4 billion as of June 30, 2025. The company once again reminded Wall Street of its unique hybrid nature—half business intelligence firm, half Bitcoin ETF. What’s remarkable is that despite modest core business growth (+2.7% YoY revenue), the Bitcoin appreciation powertrain redefined MSTR’s earnings outlook overnight.

From my analysis—and corroborated by the sentiment among Reddit traders and professional chartists alike—this quarter structurally reshapes MSTR’s risk/reward profile in the near term. With broader Bitcoin bullishness returning, MicroStrategy remains one of the most leveraged equity plays on BTC in existence.

Earnings Highlights

- Revenue: $114.49 million (vs. estimate of $112.96 million) — +2.7% YoY

- EPS: $32.60 (vs. consensus estimate of -$0.12) — +6,456% YoY, +33,254% relative to estimate

- Net Income: $10.0 billion

- Operating Income: $14.03 billion; margin of 12.2%

- Gross Margin: Slightly down YoY by 3.5pp

Segment Breakdown:

- Product Licenses: $7.2 million (-23% YoY)

- Subscription Services: $40.8 million (+69.5% YoY)

- Product Support & Services: Combined decline YoY (~-13%)

- Digital Asset Holdings: 628,791 BTC valued at $64.4B

- Free Cash Flow: Not disclosed

- Guidance: None provided for Q3 or FY25

Financial Analysis

While core revenues were fairly tepid, with only a 2.7% YoY growth, the story here is fully dominated by Bitcoin-derived performance. Subscription services were the clear standout on an operational basis (+69.5% YoY), reflecting MicroStrategy’s quiet transition toward SaaS and recurring revenue models. However, product licenses (-23%) and support revenues indicate legacy segments are in secular decline.

Margins took a moderate hit (gross margin down 3.5pp YoY), but this was dwarfed by the sheer magnitude of gains stemming from digital assets. The $14.03 billion in net income represents an astonishing 12.2% margin—almost entirely due to appreciating Bitcoins on their balance sheet.

Their stated goal of a $20 billion gain on digital assets by year-end implies Bitcoin needs to push higher—potentially above $120,000. If it does, MicroStrategy could see another quarter like this, or even better. The absence of formal forward guidance is less concerning here, since the Bitcoin thesis effectively is the guidance.

From a valuation standpoint, we're in uncharted territory. Traditional P/E metrics are almost pointless due to volatility in BTC-based income. But as a high-beta play on Bitcoin’s macro trend, this remains one of the most asymmetric Bitcoin proxies on the equity market.

Technical Analysis Summary

The recent chart structure shows a textbook bullish setup. After bottoming around $280 in early Q3, MSTR formed a classic ascending triangle pattern, with multiple touches on the base line and a resistance ceiling near $335. The current price action around $326 suggests we’re consolidating just below a breakout level. A confirmed breakout above $335, especially with volume expansion, could see rapid acceleration toward $350 and then potentially $375.

There’s a strong confluence of support between $300 and $320—this zone has acted as a magnet for institutional buyers in past cycles. The Relative Strength Index (RSI) is sitting in the mid-50s, not yet overbought, providing more upside fuel. If Bitcoin breaks above $115,000—which I am watching closely—MSTR’s price is likely to reflect that with outsized leverage (2.5x correlation has held steady historically).

In terms of Fibonacci extensions, technical levels suggest upside room to $365 (a 50% retracement from the last major wave), and beyond that, price ambitions of $420–$450 are floating among bulls targeting BTC six digits.

Community Sentiment Analysis

Investor sentiment around MSTR is aggressively bullish, albeit somewhat cautious due to recent underperformance relative to Bitcoin. The dominant theme is that MicroStrategy is lagging BTC, prompting some to speculate on an imminent catch-up rally. A 15% short interest is also triggering excitement over a potential short squeeze, particularly in a strong Bitcoin environment.

One insightful observation mentioned that MSTR is currently trading at just ~1.2x its BTC holdings vs. a historical premium of 1.5–2x. That delta alone could suggest a 25–40% upside on mean reversion alone. Other traders pointed out the cyclical Saylor strategy (“issue converts, buy BTC, stock rises”) working like a leverage flywheel.

There is also some frustration—investors who've held MSTR through weeks of consolidation are now eyeing this as the last accumulation phase before what could be a parabolic rally in tandem with the next big BTC move.

Analyst Verdict

From where I stand, MicroStrategy (MSTR) is a strong speculative BUY for traders and longer-term crypto-aligned investors looking for leveraged exposure to Bitcoin without directly holding the asset. There are near-term technical catalysts ($335 breakout watch, Bitcoin over $115K) as well as fundamental narratives (institutional crypto adoption, BTC halving flows, and eventual ETF inflows) supporting the upside thesis.

That said, the stock remains extremely volatile and is essentially a leveraged Bitcoin tracker dressed as an enterprise software company. Manage your risk accordingly—maintaining tight stops around $300 and monitoring BTC levels is essential. If Bitcoin stalls or retraces sharply, MSTR will follow.

To Watch Next:

- Breakout confirmation above $335

- Bitcoin regaining $115K+

- Short interest liquidation

- Institutional flows post-Fed guidance (impact on Bitcoin risk appetite)

Stay nimble, trade smart.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.